Truecaller’s Revenue Falls Short of Estimates, Shares Drop

Stock Market Tumbles as Truecaller Reports Lower-than-Expected Revenue

Shares of Truecaller plummeted to a low of $24.47 on Friday, a significant drop from its previous price of $35.95, before recovering slightly. The Switzerland-based firm, known for its popular caller ID app, reported revenue that fell short of estimates.

Revenue Decline

Truecaller’s quarterly revenue stood at SEK 399 million ($35.88 million), marking an 11% year-on-year decline. JP Morgan had forecast Truecaller’s Q3 revenue to be SEK 469 million, indicating a shortfall of around 15%. This decline in revenue has sent shockwaves through the stock market, with shares plummeting.

Breakdown of Revenue

The breakdown of Truecaller’s revenue reveals that:

- Ad revenues: Weak at -19.9%, which is lower than the expected -3.7%.

- Consumer revenue: Strong growth at +19.4%, which is in line with expectations.

- Other revenue: Significant growth at +43.8%, slightly below the forecasted +48.9%.

Implications for Truecaller

The decline in ad revenues is particularly concerning, as this segment accounts for around 80% of Truecaller’s overall revenue. Analysts have noted that if CPM (cost per thousand impressions) remains stable, it could imply a 10% risk to consensus FY24 revenues.

New Digital Personal Data Protection Act

Truecaller has been conducting tests to assess the potential impact on user lifetime retention in light of the new Digital Personal Data Protection Act in India. These tests involved presenting different search results to distinct user groups on a large scale, using AI identity technology.

Promising Results

The initial results are highly promising, with Truecaller noting that it has not observed any material change in retention. This is a significant development for the company, as it looks to adapt to changing regulations and maintain its user base.

Conclusion

Truecaller’s revenue decline has sent shockwaves through the stock market, with shares plummeting to $24.47 before recovering slightly. The breakdown of revenue reveals weak ad revenues, while consumer and other revenue segments are performing relatively well. Truecaller’s ability to adapt to changing regulations, such as the Digital Personal Data Protection Act in India, will be crucial in maintaining its user base and revenue growth.

Key Statistics

- Quarterly revenue: SEK 399 million ($35.88 million)

- Year-on-year decline: 11%

- Forecasted Q3 revenue: SEK 469 million

- Ad revenues: Weak at -19.9%

- Consumer revenue: Strong growth at +19.4%

- Other revenue: Significant growth at +43.8%

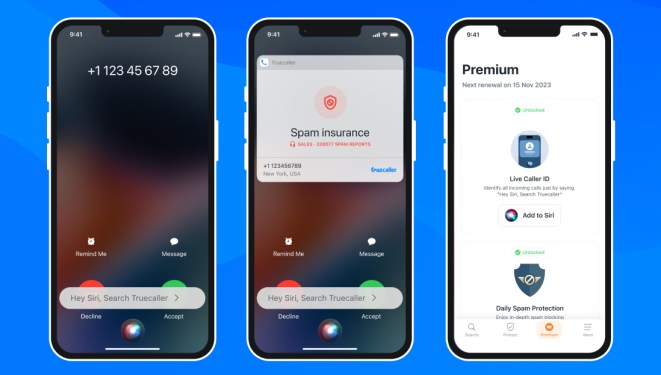

About Truecaller

Truecaller is a caller ID and spam blocking mobile app that offers a range of services, including in-app advertising. With over 368 million global monthly active users (~75% in India), the company handles over 3.2 billion calls each day.

Sources

- JP Morgan analysts: JPMorgan analysts wrote in a note that CPM has dropped to SEK0.96 (similar to Q1 0.94) when cons was modelling 1.03.

- Truecaller management: Truecaller notes it has conducted tests to assess the potential impact on user lifetime retention in light of the new Digital Personal Data Protection Act in India.

Related News

- Stock Market Tumbles as Tech Companies Report Lower-than-Expected Revenue

- Truecaller’s Competitors: Who Else is in the Caller ID and Spam Blocking Space?

- The Future of Advertising: Will Ad Revenues Continue to Decline for Truecaller and Other Tech Companies?