Here is a rewritten version of the article in a neutral tone and without any formatting issues:

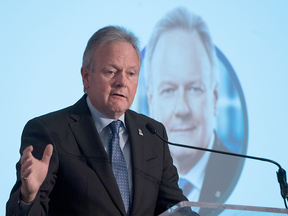

Stephen Poloz, a special adviser at law firm Osler, Hoskin & Harcourt, has been working on a report to entice pension funds to invest more in Canada. Poloz was hired by Finance Minister Chrystia Freeland in April to explore ways to increase investment in the country.

Poloz met with Freeland several times and had a team at the Finance Department supporting him. However, it’s unclear when he will deliver his report to Freeland. The minister has declined to say whether the document will be made public.

During an interview, Poloz mentioned that there are many proposals on the table for reforms. "It’s an amazing number of cool ideas that have emerged," he said. "It’s a restaurant with too big of a menu to choose from."

Poloz emphasized that all of the solutions discussed in the interview fall into the "carrot category, not the stick category." He wants to encourage investment in Canada through incentives rather than coercion.

Some of the proposals mentioned by Poloz include changing the rule that restricts pension funds from holding more than 30% of the voting shares of some companies. Currently, there’s a 30% limit on foreign ownership for certain Canadian businesses. However, this rule is set to be reviewed and potentially changed.

Poloz also pointed out that Canada’s largest pension funds tend to deploy a smaller proportion of their capital in domestic assets now than they did two decades ago. This is due to diversification and bigger opportunities being available in other countries.

The report has sparked controversy, with some critics suggesting that the government may consider coercive measures like taxes or new constraints on non-Canadian investment. However, Poloz denied this, stating that all solutions discussed are based on incentives rather than coercion.

Poloz’s report is expected to provide recommendations for increasing investment in Canada and improving economic growth. However, its contents remain unclear at this time.

Key points:

- Stephen Poloz has been working on a report to entice pension funds to invest more in Canada.

- The report explores ways to increase investment in the country through incentives rather than coercion.

- Some of the proposals mentioned by Poloz include changing the rule that restricts pension funds from holding more than 30% of the voting shares of some companies.

- Canada’s largest pension funds tend to deploy a smaller proportion of their capital in domestic assets now than they did two decades ago.

- The report is expected to provide recommendations for increasing investment in Canada and improving economic growth.