Since Donald Trump’s election to the U.S. presidency on November 5th, Bitcoin (BTC) has seen a remarkable surge of around 47%, leaving the S&P 500 in its wake with a modest gain of just 4%. The incoming president’s friendly stance towards Bitcoin and cryptocurrency is undoubtedly a contributing factor, but what other market dynamics are at play?

The Republican Sweep: Implications for Crypto Legislation

One significant development that may impact the crypto space is the Republican sweep of the Senate and House of Representatives. With their majority in both chambers, Republicans will ultimately determine the fate of laws related to cryptocurrency. While this may initially seem ominous for Bitcoin and other cryptocurrencies, it’s essential to consider the broader implications.

A Shift in Monetary Policy: The Fed’s Hawkish Rate Cut

According to Andre Dragosch, Head of Research at Bitwise in Europe, another crucial factor contributing to the divergence between Bitcoin and stocks is the Federal Reserve’s recent shift in monetary policy. In December, the Fed revised its planned rate cuts for 2025 from three to just two, a move that caught traditional financial markets off guard.

"My view on bitcoin versus S&P 500 is that the stock market has been negatively affected by the Fed’s hawkish rate cut in December," Dragosch explained exclusively to CoinDesk. "The Fed revised its planned rate cuts for 2025 to just two, less than previously telegraphed and also less than anticipated by traditional financial markets."

The U.S. Dollar’s Rise: A Potential Headwind for Risk Assets

In addition to the Fed’s rate cut revision, another key factor influencing the market is the rise of the U.S. dollar. The DXY index, which measures the value of the greenback against a basket of major currencies, has increased by 5% over recent periods. Typically, this would put pressure on risk assets like Bitcoin; however, Dragosch points out that other factors are at play.

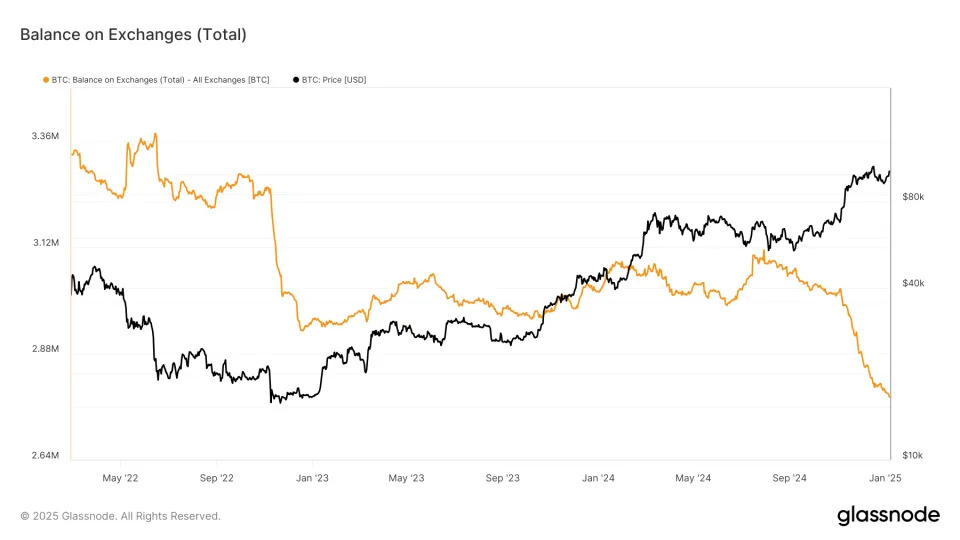

"While a strong dollar might usually be a headwind for bitcoin, it’s not having as much of an impact as one might expect," he noted. "This is partly due to the ongoing bitcoin supply deficit on exchanges, which has continued to drift lower despite profit-taking."**

Correlation Between Bitcoin and Stocks: A Recent Shift

In recent periods, the correlation between Bitcoin and the S&P 500 has seen a notable shift. According to TradingView data, their correlation has risen to 0.88 over the most recent 20-day moving average, indicating that they are now moving closely together.

"While on-chain factors will likely provide a significant tailwind at least until mid-2025, the deterioration in the macro picture could pose short-term risks for bitcoin as well, especially given its relatively high correlation with the S&P 500," Dragosch warned.

The Road Ahead: Balancing On-Chain Factors and Macro Trends

As we navigate this complex market landscape, it’s essential to consider both on-chain factors and macro trends. While Bitcoin’s supply deficit on exchanges remains a supportive factor, the growing correlation with stocks and the deteriorating macro picture may pose risks for short-term price stability.

Conclusion: A Delicate Balance Between On-Chain Factors and Macro Trends

As we look ahead to 2025 and beyond, it’s clear that Bitcoin and cryptocurrency markets will continue to be influenced by a complex interplay of factors. While the Republican sweep, Fed rate cuts, and rising dollar may have short-term implications, on-chain factors like supply deficits will undoubtedly provide support.

Ultimately, investors would do well to remain vigilant and adaptable in response to changing market conditions. By balancing on-chain analysis with macro trends, we can better navigate this rapidly evolving landscape and uncover new opportunities for growth.

Additional Insights from Andre Dragosch

As a seasoned expert in the cryptocurrency space, Dragosch’s insights offer valuable context and perspective for investors:

- "The stock market has been negatively affected by the Fed’s hawkish rate cut in December. This, combined with the rising dollar, is putting pressure on risk assets like Bitcoin."

- "While a strong dollar might usually be a headwind for bitcoin, it’s not having as much of an impact as one might expect due to the ongoing bitcoin supply deficit on exchanges."

- "The correlation between Bitcoin and stocks has risen to 0.88 over recent periods, indicating that they are moving closely together."

By staying informed about these market dynamics and adapting our strategies accordingly, we can position ourselves for success in this rapidly evolving landscape.

Final Thoughts: A Call to Action

As we move forward into the unknown, it’s essential to remain informed, adaptable, and open-minded. By balancing on-chain analysis with macro trends, we can uncover new opportunities for growth and navigate this complex market landscape with confidence.

In conclusion, Bitcoin’s remarkable rally since Donald Trump’s election is just one aspect of a broader market story. As we continue to navigate the intersection of crypto and traditional finance, it’s essential to remain vigilant and adapt our strategies in response to changing market conditions.

What do you think about the current state of the cryptocurrency markets? Share your thoughts in the comments below!

- Follow us for more news and insights on Bitcoin, Ethereum, and other cryptocurrencies.

- Stay up-to-date with the latest market trends and analysis by subscribing to our newsletter.